(note: this release is translated and condensed from the German original)

Tractable has established a German subsidiary, Tractable GmbH, to expand its business in this important insurance market.

Tractable’s technology assists with the evaluation and settlement of insurance claims amounting to more than 1.8 billion euros annually worldwide. In the motor insurance sector, Tractable’s customers include the French market leader Covéa, as well as the No. 1 and No. 2 in Poland PZU and Warta (part of the Talanx Group).

With Mario Vierschilling, Tractable was able to gain an experienced manager in automotive claims management as the new Head of Automotive DACH for its German subsidiary. He comes from used car data provider Carfax, where he was Manager Bank & Insurance Business.

Previously, Mr. Vierschilling was responsible for Sales Management DACH at FRISS, a provider of risk and fraud detection software for insurers, and was Key Account Manager at Eucon, a technology provider in claims management for insurers. Tractable will further expand its team in Germany to be able to optimally support its customers.

While insurance companies in other European countries were early adopters of AI in the digitization of their claims management processes, German insurers are still lagging behind in this area and have often not yet discovered the potential of this technology for themselves.

Yet the pressure to cut costs is enormous, especially in the area of motor vehicle insurance. It has almost become a national sport for German insurance customers to find the best insurance rate for their vehicle every year using numerous comparison portals. As a result, more and more customers are finding themselves with direct insurers, direct subsidiaries and online offshoots of the major insurance groups. Policies are managed online or via app. Correspondence is increasingly taking place purely digitally.

“Germany is the third-largest insurance market in the world in the area of non-life insurance, and an economic heavyweight within the EU, thanks to which Tractable has been able to grow so quickly. We therefore decided to create a solid foundation for our growth in this very important market for us by establishing our German subsidiary and building a German team,” said Alex Dalyac, CEO, Tractable.

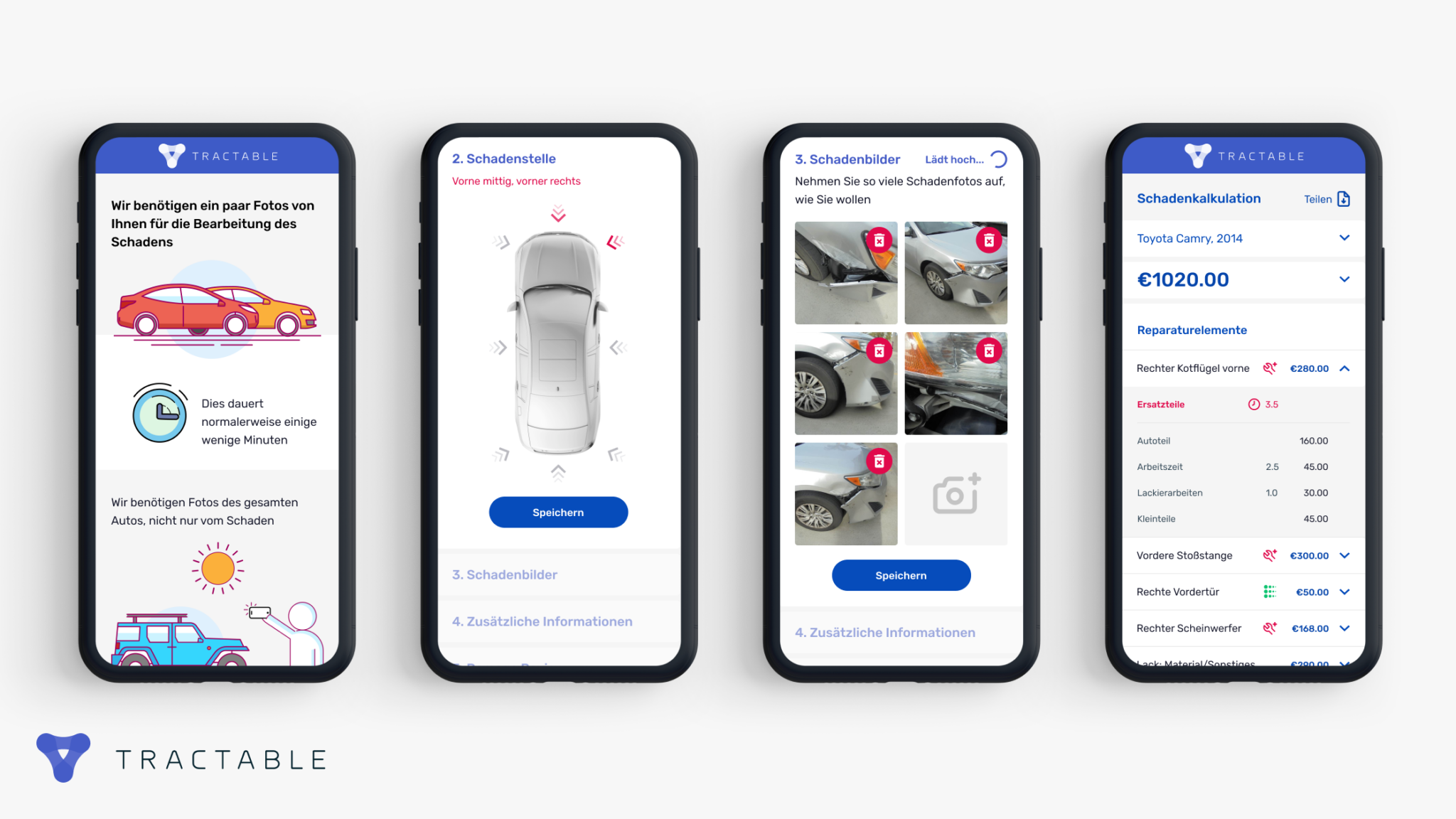

When a car accident occurs, policyholders (or their repair shop) can send photos and videos of the damage to the insurer. Tractable’s AI-powered software solution analyzes them in real time and creates an assessment of the damage, including needed repair measures and their costs.

Insurers can thus directly offer their customers a cash settlement or a direct release for a repair. Total losses are quickly identified as such, so that the next steps can be taken immediately. Faster repair releases reduce the cost of rental cars. Earlier return of the vehicle leads to better service and more satisfied customers.

With Tractable, insurers can significantly speed up their claims management processes and make them more efficient in order to compete in the highly competitive automotive policy market. Faster claims processing also leads to better customer service and increases customer loyalty.

“AI-powered image recognition solutions for claims assessment are marketed with many promises. Tractable has already been successful on the market with its solution for years and is in productive use at 20 of the world’s 100 largest insurance companies,” said Mario Vierschilling, Head of Automotive DACH, Tractable GmbH.

“I would like to approach German insurers and answer any questions they may have about the topic of AI. For example, local insurance agents can be strengthened in their role as the first point of contact for the customer. With Tractable, they can make initial claims assessment statements themselves and accompany customers accordingly.”